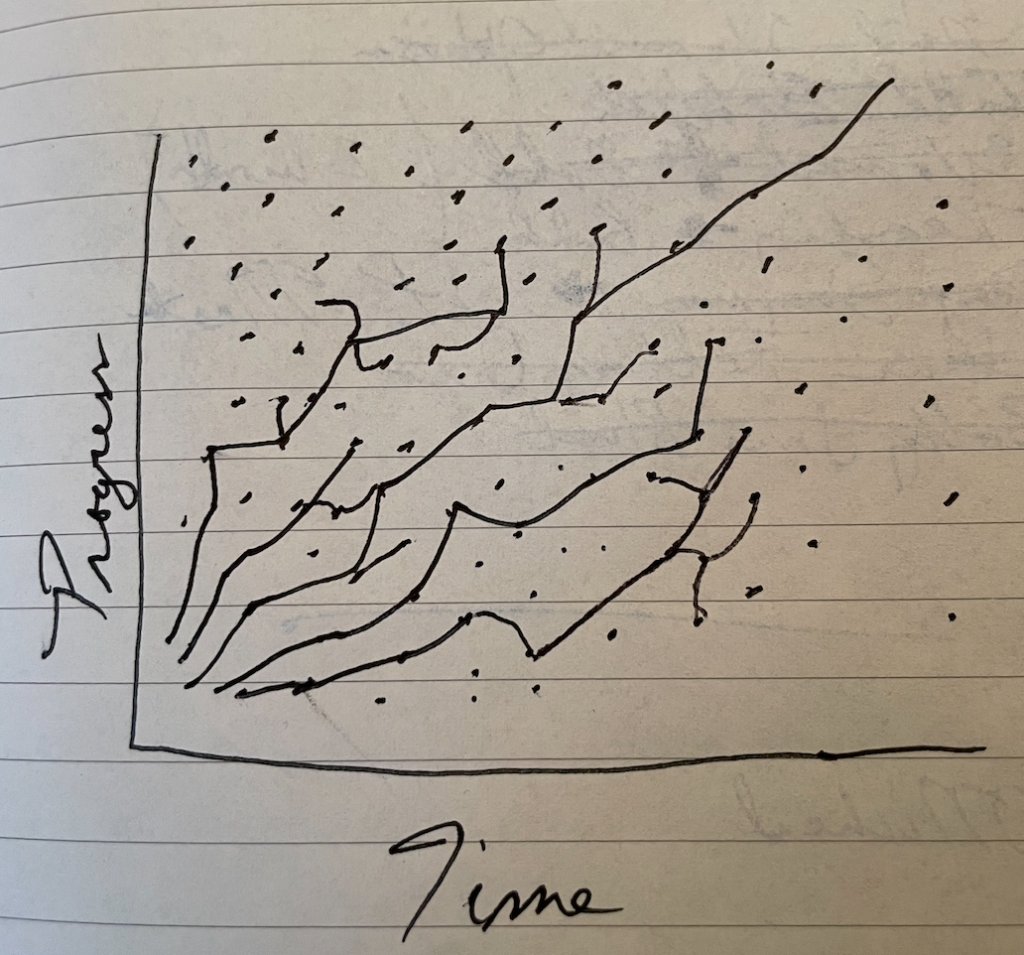

One of the most quoted and transformative blog posts I’ve read to build relationships and fundraise came from Mark Suster titled Invest in Lines, Not Dots. I refer this blog post almost weekly in conversations. The premise is simple: when investors write a check, they are investing in a series of interactions and meetings versus one data point or “dot.” The more dots, or meetings, emails, and conversations, the more defined the line and therefore the stronger the trust and foundation of the investment and relationship.

Suster’s theory is powerful as it frames the conversation in a longer-term perspective than a one-meeting decision or interaction.

How does an entrepreneur and investor build lines versus dots?

The short answer is to be available, but knowing time is of the essence for all parties, how to execute is worth covering.

From the entrepreneur’s perspective, the best way to build lines on the investor front is to be open to strategic coffees and lunches (2-5% of your time) and then build a scalable process of updating the investors, friends, and supporters you’ve collected along the way. I love Suster’s suggestion to “meet your potential investors early. Tell them you’re not raising money yet but that you will be in the next 6 months or so. Tell them you really like them so you want them to have an early view (which is what all investor’s want).”

Introductions from successful entrepreneurs is the best way to get in front of investors.

A regular cadence of emails to this group is an effective and scalable use of time to form a sincere coalition of people who want to see (and help) you succeed. When that engine of communication starts, a flywheel of momentum begins and you, as the entrepreneur, will see who truly leans in, adds value, and cares the most before any form of legal partnership commences.

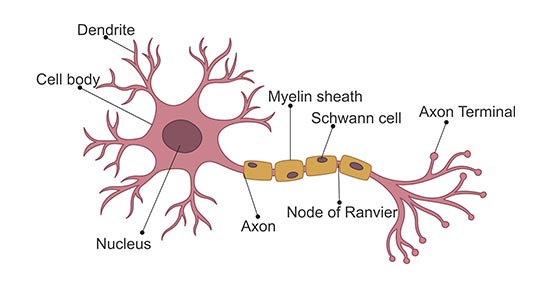

From the investors’ perspective, the best way to align the dots is to generate neurons.

Great investors treat every dot like a neuron and the dendrites are pay-it-forward connections they can make for the entrepreneur. A significant portion of an investor’s role is to meet people. These people are most likely entrepreneurs, students, or people looking to time their next rocket ship. This network can be valuable for the next dot. Allowing freedom and flexibility to pay it forward and generate as many new dots as possible takes time, patience, and commitment from the firm. From my experience, permanent capital, a growing trend in venture, yields the greatest space, patience, and vision to let those dots take place and neurons form connections or synapses (keeping with the metaphor).

The two best ways to individually pay it forward to entrepreneurs include: introductions to potential customers and introductions to potential hires. Individual introductions produce the strongest synapses. Action and follow up items from both parties in the introduction will more than likely occur.

If you want to generate more scale, group lunches or coffees produce powerful ingredients while providing opt-in optionality for builders to take a brief respite from the tunnel vision required to grow a business. While serendipity is likely, value creation is not alway guaranteed labeling this tactic under “medium synapses strength.”

Writing, tweeting, posting to LinkedIn, and holding large group events like the Atlanta Startup Village are the most scalable ways to generate dots yet the synapses have the least vitality. Ironically, one of Suster’s posts, 12 years ago, started this entire exercise!

If investors produce enough neurons, with the right intent, and do it long enough, a flywheel of magnificent, brilliant, ambitious human beings orbit each other’s calendars.

In the early years of startups, one spark or introduction can transform the company; a customer relationship is formed, a co-founder finds the perfect startup, a lifelong friendship is formed from a seemingly random dinner. These instances have happened several times over and over again – and make a dramatic impact.

They are tough to predict, but that is the fun part of generating neurons.